Designing and developing strategies to secure an individual’s future financial security demands careful analysis, and the understanding and use of many legal instruments. In our minds, a Living Trust without a doubt is one of the most important of these instruments. Let us take a moment to explain just why you should care about this subject.

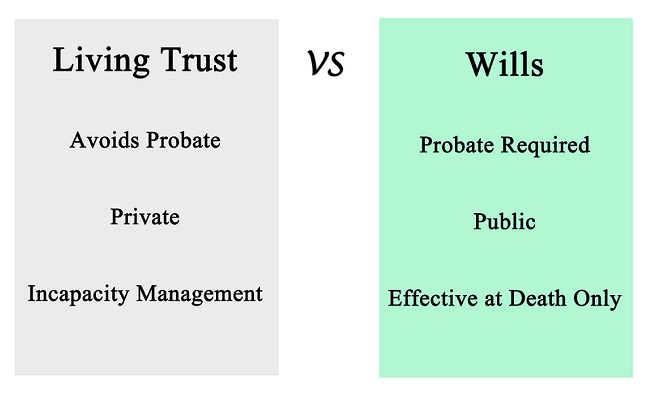

Unlike a will, which is a legal expression of how a person wants their assets distributed upon their death, a trust is an agreement in which one party holds the property for the benefit of another. Created while the person is alive, a trustee controls the property, funds, and assets in the interest of a designated person or persons. At one time thought of being just for the wealthy, this strategy allows transferred property to avoid the probate process and limits tax liability.

A significant advantage of using a trust is that by avoiding probate, the trustee can distribute assets to beneficiaries more quickly. This legal tool is beneficial to most families because it saves time, money, and eliminates other complications. Also, a trust, unlike a will, is a private document which means that the public will not know details about the estate or the beneficiaries.

Probably the most popular Living Trust is the revocable trust. With this type of instrument, the donor can change the terms and beneficiaries of the trust at any time, retaining full control of all assets. Revocable trusts are popular because they allow the donor to control his assets as well as dissolve the trust and talk back complete control at any time, while financially protecting beneficiaries.

In a Living trust, assets aren’t considered part of your estate and not subject to estate taxes. Probate proceedings are time-consuming and, the inevitable taxes are expensive. Trusts allow you to leave money to your beneficiaries without court interference.

To talk more about this, and your specific needs, please Contact Us.